Shale Drillers Are Staring Down Barrel at Worst Oil Bust Yethttps://www.bloomberg.com/amp/news/articles/2020-03-09/shale-drillers-are-staring-down-the-barrel-of-worst-oil-bust-yetAmerica’s shale drillers have never faced an oil bust quite like this.

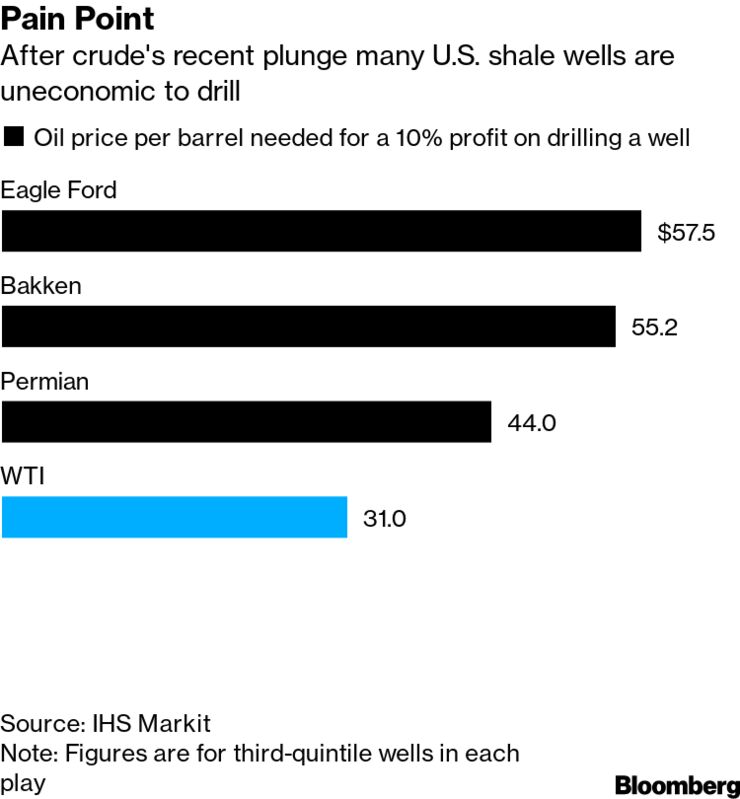

The split between Russia and its one-time OPEC allies last week has ignited an all-out price war. U.S. crude prices plunged the most since the 1990s, falling to less than $28 a barrel and rendering vast swathes of the U.S. oil industry unprofitable. Shares and bonds of shale producers plunged Monday, with the S&P 500 Energy Index posting its worst intraday decline on record.

It’s a disaster for U.S. frackers including Chesapeake Energy Corp. and Whiting Petroleum Corp., who were already trading at distressed levels -- and makes more defaults and bankruptcies all but certain. After burning through hundreds of billions of dollars in cash over the past decade, the industry has consistently disappointed investors while accumulating huge debts. It now finds itself backed into a corner, increasingly shut out of capital markets. Banks were already poised to cut credit lines after writing off as much as $1 billion in shale loans last year, more than they have in 30 years of making them.

This could mark the end of a historic boom that vaulted the U.S. to predominance in world crude production. On Monday, shale producers Diamondback Energy Inc. and Parsley Energy Inc. said they’re cutting the number of drill rigs in response the price slump.

The current price crash has echoes of 1986, when Saudi Arabia abandoned attempts to prop up a glutted market and pumped at will, sending oil futures plunging by more than half in a matter of months.

But never before has so much U.S. output been in such peril -- and never has demand for that supply been so uncertain. When financial markets collapsed in 2008-2009, dragging crude demand and prices down with them, America’s shale patch as it is now didn’t exist. Oil drillers in the Permian were just warming up to the idea of hydraulic fracturing and pumping less than 1 million barrels a day.

When oil tumbled to a 13-year low in early 2016, driven by a glut of supplies worldwide, the fracking revolution was indeed in full swing. But demand was strong and the region had still not yet topped 2 million barrels a day.

Today, the Permian churns out more than 5 million barrels, exceeding Iraq and accounting for more than one-third of America’s total production. Shale companies weathered the last major downturn in 2018 by getting lean and plowing forward with drilling plans. This time around, they’re in a more precarious financial position and can’t afford to keep adding to a glut.

“This industry shot itself in the foot with dramatic shale production growth,” said Dan Pickering, founder and chief investment officer of Houston-based asset manager Pickering Energy Partners. Drillers need “a dose of self help,” he said. “It’s kind of them against the world right now.”

American shale companies are largely responsible for years of swelling world supply. Indirectly, they’ve been supported by OPEC nations and their allies cutting production to prop up prices. But the key Saudi-Russia “bromance,” as it was once described by Citigroup Inc. oil analyst Ed Morse, is over. No longer is Russia willing to bail out U.S. shale.

Ominously, Russian Energy Minister Alexander Novak said in Vienna on Friday that his nation’s producers will be free to pump at will when current production caps expire at the end of the month. Saudi Arabia in turn started an all-out oil price war on Saturday, slashing its official selling prices by the most in 20 years in an effort to push as many barrels into the market as possible.

That leaves American shale drillers scant time to prepare for an onslaught from the rest of the world’s oil behemoths.

“The vultures already are circling,” said Amy Myers Jaffe, a senior fellow at the Council on Foreign Relations, who is frequently sought out by OPEC ministers and industry leaders for her views on oil. “What is the appetite for investors to refinance a new round of shale?”

Shale drillers large and small are being pummeled by equity investors. After big drops on Friday, most of the 57 members of the S&P Oil & Gas Exploration & Production Select Industry Index fell Monday. Shale producers Oasis Petroleum Inc., California Resources Corp. and Occidental Petroleum Corp. tumbled more than 40%.

Energy bonds also plummeted, with the average spread over Treasuries for companies in the Bloomberg Barclays High Yield Energy index surging above 10% for the first time since 2016, a threshold typically associated with distress. SM Energy Co. and Oasis Petroleum Inc. led high-yield declines. SM’s 6.625% notes due 2027 fell 34 cents to 36 cents on the dollar, to yield about 28%.

With oil at about $30 a barrel, some shale explorers will find it impossible to pay lenders and support newly minted dividend programs adopted to entice retail investors. In addition, promises to finally generate free cash flow -- which has become something of an obsession in parts of the industry -- may be for naught.

“There’s the old joke about the sign in the bar that says ‘free beer tomorrow,’” said Michael Roomberg, who helps manage $4 billion at Miller Howard Investments Inc. For shale drillers, “becoming free cash flow positive is something similar. And clearly this price reaction may delay that inflection point even further.”

For many observers, the path ahead for the U.S. shale sector appears to be painful and uncertain. Even before Friday’s dramatic events, some forecasters, including Goldman Sachs Group Inc., expected global oil demand to shrink in 2020 for only the fourth time in nearly 40 years due to the effects of the coronavirus. A rationalization of the hundreds of independent U.S. producers currently active appears inevitable, according to Ian Nieboer, managing director of RS Energy, now part of Enverus.

“What we’re going to end up with is a major hollowing out of the industry,” he said.